Dear Fellow Stockholders:

On behalf of yourApril 5, 2024

Babcock & Wilcox Enterprises, Inc.

1200 East Market Street, Suite 650

Akron, Ohio 44305Via live webcast at www.virtualshareholdermeeting.com/BW2024

Dear Fellow Stockholders: On behalf of our Board of Directors (the “Board”), we are pleased to invite you to attend the Babcock & Wilcox Enterprises, Inc. (“B&W” or the “Company”) 2024 Annual Meeting of Stockholders on May 15, 2024 (the “Annual Meeting”). This will be a virtual meeting of stockholders, beginning at 10:30 a.m. Eastern Time. You may attend the Annual Meeting online and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/BW2024. You also will be able to vote your shares electronically at the Annual Meeting (other than shares held through the B&W Thrift Plan, which must be voted prior to the meeting), although we would urge you not to wait until the meeting to vote your shares. We invite you to read this year’s proxy statement highlighting key activities and accomplishments in 2023 and presenting the matters for which we are seeking your vote at the Annual Meeting. Strengthening our Foundation and Accelerating Growth Despite sustained global economic and geopolitical challenges, our traditional businesses returned solid results in 2023, led by our aftermarket parts, services and construction operations that capitalized on the continued strong demand for baseload power generation as customers seek to extend the operational lifespans of their existing power generation and industrial facilities. We also accelerated our momentum in the deployment of our patented BrightLoop™ low-carbon, hydrogen generation technology that can use solid fuels like coal and biomass, as well as others like natural gas, to produce hydrogen while capturing carbon dioxide. This included announcing our hydrogen generation and carbon capture project with Black Hills Energy in Gillette, Wyoming, and our progress in establishing a BrightLoop hydrogen production plant in Massillon, Ohio. These accomplishments would not be possible without the outstanding efforts and dedication of B&W employees throughout our global operations. They are experienced problem solvers and technology experts and have earned the trust of customers around the world. We’re excited about the opportunities ahead and for the opportunity to achieve sustained growth in 2024 and beyond. We’ll do that by capitalizing on the strengths of our technology and experienced employees, by driving greater efficiencies throughout our operations and by working together to deliver on our projects safely and profitably. Together, we are focused on generating strong, profitable growth, to serving our vast installed base and further expanding our role as a leader and innovator in the energy transition. We sincerely appreciate your interest in our company, and your confidence in our ability to execute on our strategic priorities and create strong, sustainable results for the long-term. We’re looking forward to a bright future and to continuing to deliver products, services and solutions that drive the world toward a cleaner tomorrow. We Welcome Your Feedback We hope you will participate in the Annual Meeting to hear more about our operations and our progress, and we encourage you to share your thoughts, concerns and suggestions with us. We also want to ensure your shares are represented as we conduct a vote on the matters outlined in this proxy statement. Whether or not you plan to attend, please cast your vote as soon as possible either via: •

the internet at www.proxyvote.com,

•

by calling 1-800-690-6903, or •

by returning the accompanying proxy card if you received a printed set of materials by mail. Further instructions on how to vote your shares can be found in this proxy statement. On behalf of our Board of Directors and the employees of B&W, I want to thank you for your confidence in us and your investment in our business. If you have any questions or suggestions, please feel free to contact us at the address above or by visiting our website. Sincerely, Kenneth M. Young

Chairman and Chief Executive Officer

| | April 5, 2024

Babcock & Wilcox Enterprises, Inc. (B&W) 2017 Annual Meeting of Stockholders on Tuesday, May 9, 2017 at The Ballantyne Hotel, 10000 Ballantyne Commons Parkway, Charlotte, North Carolina, 28277. The meeting will be held in The Carolina Room beginning at 9:30 a.m. local time.

1200 East Market Street, Suite 650

Akron, Ohio 44305 | | | We also invite you to read this year's proxy statement that highlights key activities and accomplishments in 2016 and presents the matters for which we are seeking your vote at the 2017 Annual Meeting.

Looking Back and Ahead

The past year has been one of opportunity, progress and challenge for Babcock & Wilcox, as we made measureable advances on our three-pronged strategy to:

•

Optimize our Business and Improve Efficiency;•

Pursue Core Growth in Global Markets; and•

Execute a Disciplined Acquisition Program to Drive Growth and Diversification.

Our strategy defines what we see as a critical path to creating long-term value for stockholders by better servingour traditional power customers, growing our industrial market presence and increasing our non-coal revenue base. Our actions in 2016 supported this strategy as we worked to realign our businesses, enhance our operations and diversify our revenue sources. We will remain focused on this strategy in the year ahead as we strengthen our internal project execution capabilities in our growing business units and ensure that we continue to deliver on our commitments to our customers.

Our Corporate Governance

We have continued to be guided by strong corporate governance practices that demonstrate our commitment to ethical values, to strong and effective operations and to achieving growth and financial stability for our stockholders. Our engaged, committed and diverse Board also serves as a competitive advantage that helps to guide and oversee our company, and we believe that our ‘pay for performance’ philosophy must continue to be the fundamental principle underlying our compensation program. As B&W continues to grow as an independent company, we expect to continue to evolve and enhance our corporate governance practices.

Your Viewpoint is Important

We hope you are able to attend our annual meeting to hear more about our operations and our progress, and we encourage you to share your thoughts, concerns and suggestions with us. We also want to ensure your shares are represented as we conduct a vote on the matters outlined in the proxy statement. If you are unable to attend, please cast your vote as soon as possible either via:

•

the Internet at www.proxyvote.com•

by calling 1-800-690-6903, or•

by returning the accompanying proxy card if you received a printed set of materials by mail.Further instructions on how to vote your shares can be found in our proxy statement.

B&W is marking its 150th anniversary in 2017, and while we are proud of the difference our company's products and services have made in the world since 1867, we are even more excited about our opportunities for the future. On behalf of the Board of Directors and the more than 5,000 employees of B&W, I want to thank you for your continued support and investment in our business. We value the ongoing dialogue we have with our stockholders and welcome your suggestions. Please feel free to contact us at the address below or by visiting our website.

| Board of Directors

Babcock & Wilcox Enterprises, Inc.

13024 Ballantyne Corporate Place

Suite 700

Charlotte, NC 28277

c/o J. André Hall, Corporate Secretary | Sincerely, | | E. James Ferland

Chairman & Chief Executive Officer

|

March 28, 2017

Babcock & Wilcox Enterprises, Inc.

13024 Ballantyne Corporate Place, Suite 700

Charlotte, North Carolina 28277

NOTICE OF 20172024 ANNUAL MEETING OF STOCKHOLDERS The 20172024 Annual Meeting will be a virtual meeting of stockholders, beginning at 10:30 a.m. Eastern Time on May 15, 2024. You will be able to attend the Stockholders (the “Annual Meeting”) of Babcock & Wilcox Enterprises, Inc., a Delaware corporation (the “Company”),Annual Meeting online and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/BW2024. You will also be able to vote your shares electronically at the Annual Meeting (other than shares held through the B&W Thrift Plan, which must be voted prior to the meeting). The Annual Meeting will be held in The Carolina Roomto: (1)

approve amendments to the Company’s Restated Certificate of Incorporation (“Certificate of Incorporation”) to declassify the Company’s Board of Directors (the “Board”) and provide for annual elections of all directors beginning at The Ballantyne Hotel, 10000 Ballantyne Commons Parkway, Charlotte, North Carolina 28277,the 2026 annual meeting of stockholders; (2)

if Proposal 1 is approved and our Board is re-classified, elect Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller as Class I directors of the Company for a term of two years; (3)

if Proposal 1 is not approved, elect Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller as Class III directors of the Company for a term of three years; (4)

approve amendments to the Company’s Certificate of Incorporation to remove provisions that require the affirmative vote of holders of at least 80% of the voting power to approve certain amendments to our Certificate of Incorporation and Bylaws; (5)

ratify our Audit and Finance Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024; (6)

approve, on May 9, 2017, at 9:30 a.m. local time to:a non-binding advisory basis, the compensation of our named executive officers; and | | (1) | elect Stephen G. Hanks and Anne R. Pramaggiore as Class II directors of the Company; |

| | (2) | ratify our Audit and Finance Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2017; |

| | (3) | approve, on a non-binding advisory basis, the compensation of our named executive officers; and |

| | (4) | transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

(7)

transact such other business as may properly come before the Annual Meeting or any adjournment thereof. If you were a stockholder as of the close of business on March 13, 2017,18, 2024 (the “record date”), you are entitled to vote at the Annual Meeting and at any postponement or adjournment thereof. To participate in the Annual Meeting via live webcast, you will need the 16-digit control number included on your proxy card and on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 10:30 a.m. Eastern Time. Online check-in will begin at 10:25 a.m. Eastern Time. InsteadIf you are a stockholder of record, you can vote your shares by voting by Internet, telephone, mailing a printed copyin your proxy or virtually at the Annual Meeting. You may give us your proxy by following the instructions included in the enclosed proxy card. Further instructions on how to vote your shares can be found in this proxy statement.

A list of stockholders entitled to vote at the Annual Meeting will be available for examination at the Company’s headquarters for 10 days prior to the Annual Meeting. The list of stockholders may also be accessed during the Annual Meeting at www.virtualshareholdermeeting.com/BW2024 by using the control number on your proxy card, voting instruction form, or Notice of Internet Availability. On April 5, 2024, we commenced providing or making available our proxy materials, including our 2016 Annual Report, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials,this notice and proxy statement as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March 28, 2017, we mailed the Noticea copy of Internet Availability of Proxy Materials (the “Notice”)our 2023 Annual Report, to all stockholders of record as of March 13, 2017 and posted our proxy materials on the Web site referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the Web site referred to in the Notice or may request a printed set of our proxy materials. The Notice and Web site provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.record date. If you previously elected to receive a printed copy of the materials, we have enclosed a copy of our 2016 Annual Report to Stockholders with this notice and proxy statement.

Your vote is important.important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. You can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the enclosed proxy card. By Order of the Board of Directors, John J. André Hall

Dziewisz

Executive Vice President,

General Counsel &

Corporate Secretary

Dated: April 5, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 15, 2024. 2017We are pleased to announce that we are delivering your proxy materials for the 2024 Annual Meeting of Stockholders via the Internet. Because we are delivering proxy materials via the Internet, the Securities and Exchange Commission requires us to mail a notice to our shareholders notifying them that these materials are available on the Internet and how these materials may be accessed. This notice, which we refer to as our “Notice of Proxy Materials,” will be mailed to our shareholders on or about April 5, 2024.

Our Notice of Proxy Materials will instruct you on how you may vote your proxy via the Internet or by telephone, or how you can request a full set of printed proxy materials, including a proxy card to return by mail. If you would like to receive printed proxy materials, you should follow the instructions contained in our Notice of Proxy Materials. Unless you request them, you will not receive printed proxy materials by mail. The Proxy Statement and Annual Report are available free of charge on our website at

https://investors.babcock.com/home/financial-reports/

and at http://www.proxyvote.com

2024 PROXY STATEMENT SUMMARY Growth Strategy2023 Pay-For-Performance

Babcock & Wilcox Enterprises, Inc. ("B&W" or the "Company") became a public company on July 1, 2015 as a spin-off from The Babcock & Wilcox Company ("BWC"). At the time of the spin-off, B&W defined a three-pronged strategy as follows:

2016 Performance

We have made measurable progress on our three-pronged strategy. This strategy provides a critical path forward to delivering long-term stockholder value by allowing us to better serve our traditional power customers, enhance our industrial market presence and increase our non-coal revenue base.

The past year, our first as an independent company, has been one of opportunity, progress and challenge. We made significant advancement realigning the business and on making the necessary changes in order to best position our operations for the future. Specifically, we focused on enhancing the profitability of our Power business and increasing revenue diversification by driving the growth of our Industrial and Renewable businesses. While some businesses were impacted by market volatility and certain execution issues, we believe our businesses have significant opportunities for growth and are confident that we are well positioned to create long-term value for stockholders.

In 2016, we made major strides in executing our strategy to become a larger player in global industrial markets. In July 2016, we closed the acquisition of SPIG S.p.A. ("SPIG"), and in January 2017, we closed the acquisition of Universal Acoustic & Emission Technologies, Inc. ("Universal"). These acquisitions expanded our global reach, increased our non-coal-related revenue to more than 50% of total revenues and expanded our end market coverage, particularly in natural gas power generation. Our effort to diversify our business has moved us forward in a measurable way, and we anticipate these efforts to continue to positively impact the Company as we position it for future success.

Despite these improvements, we faced challenging market conditions, particularly in our legacy coal-based business and also experienced operational challenges in our Renewable segment as we executed on the rapid growth in contracts from the past 12 months. These had a significant impact on our 2016 financial results. The Board has worked closely with the management team and has overseen specific actions to address these execution issues, and enhance the resources and infrastructure of the Renewable segment, enabling it to capture its significant market opportunities. We are focusing primarily on project management and engineering process improvements so that we have the right systems and resources in place to improve our performance and allow us to continue to grow this important segment of our Company.

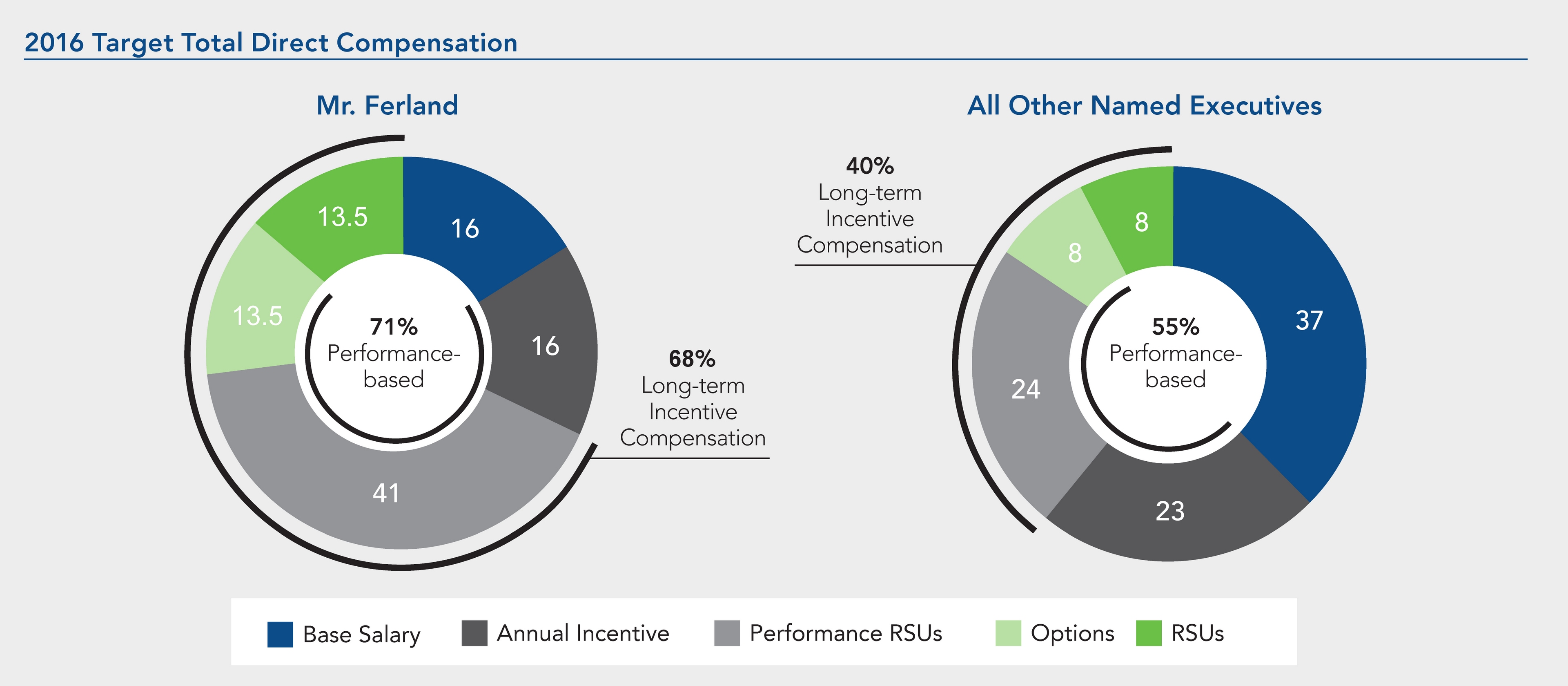

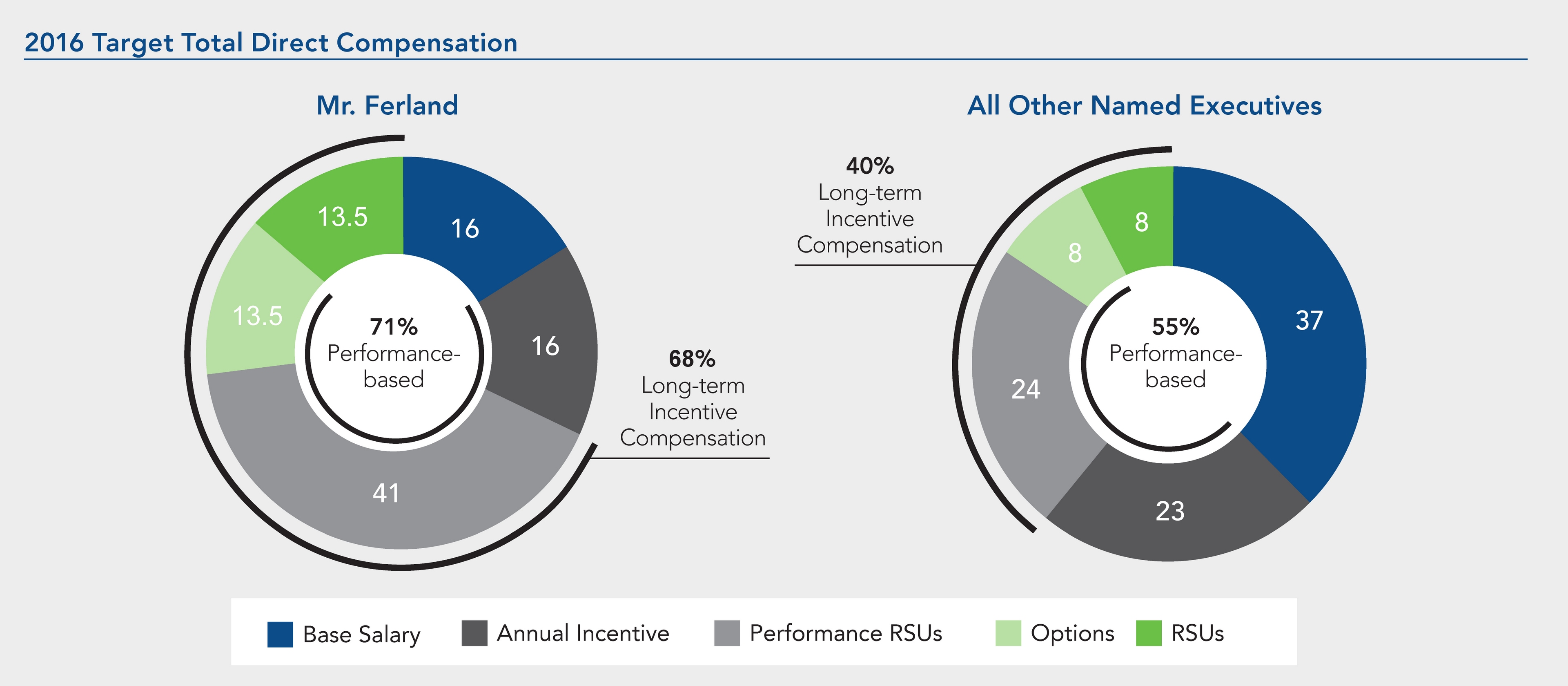

2016 PAY-FOR-PERFORMANCE

Our executive compensation programs are based on a strong alignment between pay and performance. Our compensation programs are designed to balance individualperformance, and group goals, short-this is reflected in the payout amounts under our cash incentive program and long-term goals and corporate and stockholder metrics. We expect to continue engaging with our stockholders to inform our decision making on this issue.

In light of our 2016 performance, the 2016 annual incentive payout for our NEOs and our senior management team was $0. See "2016 Summary Compensation Table" for a comparison of the total compensation received by our NEOs in 2016 versus 2015. In addition, the current projected value of the performance-based shares granted in 2016earned awards under our long-term incentive plan is significantly impaired.programs. Decisions by the Compensation Committee of the Board, which we refer to in this discussion as the “Compensation Committee,” in 2023 also took into account prior feedback from our stockholders and concern for retention of key personnel while we address operational issues.

For the sixth year in a row, no payment was earned by any of our executive officers under the financial component of our annual cash incentive program. In 2023, our executive officers did not receive equity awards under the company’s long term incentive plan.

Performance Metrics in Long-Term Incentive Compensation Program Link to Growth Strategy

Our 2016 long-term (3-year) incentive compensation metrics are designed to drive behaviors that will result in direct benefits for our stockholders.

Governance Highlights Corporate governance is important, and we believe that our governance policies and structures provide a strong framework and assurance that we are clear, ethical and transparent in all of our business dealings. They help us operate more effectively, mitigate risk and act as a safeguard against mismanagement. | | | | | | | Board Independence | | | •

•

SixFive out of seven of our directors are independent •

Our CEOChief Executive Officer is the only managementexecutive director | | | | Board Composition | | | •

Currently the board has fixed the numberBoard consists of seven directors at seven •

The board is elected pursuant to a majority vote standard • The boardBoard annually assesses its performance through boardBoard and committee self-evaluations

•

The Governance Committee leads the full boardBoard in considering boardBoard competencies and refreshment in light of companyCompany strategy | | | | Board Committees | | | •

We have three boardfour standing Board committees –— Audit and Finance, Governance, Compensation, and CompensationRelated Party Transactions •

All committees are composed entirely of independent directors | | | | Leadership Structure | | | •

Our lead independent directorLead Independent Director works closely with our chairman andChairman & CEO and provides feedback to management •

Among other duties, our lead independent director isChairman and our Lead Independent Director are involved in setting the Board'sBoard’s agenda and our Lead Independent Director chairs executive sessions of the independent directors to discuss certain matters without management present | | | | Robust Overboarding Policy | | | •

Robust director overboarding policy, with limit of three total public company boards for non-employee directors and two total public company boards for executive directors | | | | Risk Oversight | | | •

Our full boardBoard is responsible for risk oversight, and has designated committees to have particular oversight of certain key risks •Our board

The Board oversees management as management fulfills its responsibilities for the assessment and mitigation of risks, and taking appropriate risks | | | | Open Communication | | | •

We encourage open communication and strong working relationships among the lead independent director, chairmanChairman and other directors •

Our directors have access to management and employees | | | | Director Stock Ownership | | | •

Our directors are required to own five times their annual base retainerretainers in shares of common stock | | | | Accountability to Stockholders | | | •

We actively reach out to our stockholders through our engagement program •

Stockholders can contact our board, lead independent directorthe Board, Chairman or management through our website or by regular mail | | | | Management Succession Planning | | | •

The boardBoard actively monitors our succession planning and people development •

At least once per year, the boardBoard reviews senior management succession and development plans | |

Voting MattersAs part of our commitment to effective corporate governance, our management and Board reviewed current corporate governance trends and considered the view held by many institutional stockholders that a classified board structure has the potential effect of reducing the accountability of directors. Similarly, the Board considered the view held by many institutional stockholders that provisions that prohibit stockholders from amending certain provisions of the Company’s Amended and Restated Bylaws (“Bylaws”) or our Certificate of Incorporation without the approval of at least 80% of all outstanding shares of the Company’s common stock could similarly reduce the accountability of directors and management. The proposals included in this Proxy Statement reflect the Board’s consideration of these issues. VIRTUAL ANNUAL MEETING The Annual Meeting will be held in a virtual-only meeting format, via live audio webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. Our virtual-only meeting format leverages technology to enhance stockholder access to the Annual Meeting by enabling attendance and participation from any location around the world by visiting www.virtualshareholdermeeting.com/BW2024. We believe that the virtual-only meeting format will give stockholders the opportunity to exercise the same rights as if they had attended an in-person meeting and believe that these measures will enhance stockholder access and encourage participation and communication with our Board of Directors and management. BENEFITS OF A VIRTUAL ANNUAL MEETING •

We believe a virtual-only meeting format facilitates stockholder attendance and participation by enabling all stockholders to participate fully, equally and without cost, using an Internet-connected device from any location around the world. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size. •

Stockholders of record and beneficial owners as of March 18, 2024, the record date, will have the ability to submit questions directly to our management and Board of Directors and vote electronically at the Annual Meeting via the virtual-only meeting platform. ATTENDANCE AT THE VIRTUAL ANNUAL MEETING •

Attendance at the Annual Meeting is important. Please voteopen to the public online at www.virtualshareholdermeeting.com/BW2024, but you are entitled to participate in the Annual Meeting by voting or asking questions only if you were a stockholder of record or beneficial owner as of March 18, 2024, the record date. •

To participate in the Annual Meeting by voting or asking questions, you will need the 16-digit control number included on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials, as applicable. •

If you were a stockholder as of March 18, 2024, the record date, you may vote shares held in your name as the stockholder of record or shares for which you are the beneficial owner but not the stockholder of record electronically during the Annual Meeting through the online virtual annual meeting platform by following the instructions provided when you log in to the online virtual annual meeting platform. •

On the day of the Annual Meeting, Wednesday, May 15, 2024, stockholders may begin to log in to the virtual- only Annual Meeting beginning at 10:25 a.m. Eastern time, and the Annual Meeting will begin promptly so your shares can be represented, even ifat 10:30 a.m. Eastern time. Please allow ample time for online login. •

We will have technicians ready to assist you plan to attendwith any technical difficulties you may have accessing the Annual Meeting. You can voteIf you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties with your 16-digit control number or submitting questions, you may call the technical support number that will be posted on the Annual Meeting log-in page.

QUESTIONS AT THE VIRTUAL ANNUAL MEETING •

Stockholders will have the opportunity to submit questions during the Annual Meeting by Internet, by telephone,following the instructions on the virtual-only Annual Meeting platform. •

If you wish to submit a question, please submit it online at: www.virtualshareholdermeeting.com/BW2024. The meeting is not to be used as a forum to present general economic, political or by requesting a printed copyother views that are not directly related to the business of the proxy materialsCompany. We may group questions and usinganswers by topic and answer substantially similar questions only once. Each shareholder may ask up to two questions. Answers to questions will be posted on the enclosed proxy card.Investors Page on the Company’s website, www.babcock.com. We will only answer questions that comply with our Annual Meeting Rules of Conduct, which can be found on the virtual meeting site referenced above. •

We will not answer any questions that are irrelevant to the purpose of the Annual Meeting or our business or that contain inappropriate or derogatory references which are not in good taste. This summary highlights certain information contained in this Proxy Statement but does not contain all of the information that you should consider before voting. For more complete information, please review our 2023 Annual Report and this entire Proxy Statement. YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON

| | | | Page | | | | | | | 2529 | | | Peer Group | | | | | 2731 | | | Compensation Philosophy and Process | | 2016 Compensation Decisions | | Other Compensation Practices and Policies | | | COMPENSATION COMMITTEE REPORT | | | | | 3835 | | | | | | | | 3936 | | | 2016 | | | | | 3936 | | | 2016 | | | | | 4238 | | | | | | | | 4539 | | | 2016 | | | | | 4840 | | | 2016 | | | | | 4840 | | | 2016 | | | | | 5041 | | | | | | | | 5241 | | | STOCKHOLDERS’ PROPOSALS | | | | | 6445 | | | GENERAL INFORMATION | | | | | 6445 | | | VOTING INFORMATION | |

***** Cautionary Statement Concerning Forward-Looking Information ***** This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical or current fact included in this Proxy Statement are forward-looking statements. These forward-looking statements are made based upon detailed assumptions and reflect management’s current expectations and beliefs. While we believe that these assumptions underlying the forward-looking statements are reasonable, forward-looking statements are subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and may be beyond our control. Such uncertainties and factors may cause actual results to differ materially from those expressed or implied by the forward-looking statements. You should not place undue reliance on these statements. Forward-looking statements may include words such as “expect,” “intend,” “plan,” “likely,” “seek,” “believe,” “project,” “forecast,” “target,” “goal,” “potential,” “estimate,” “may,” “might,” “will,” “would,” “should,” “could,” “can,” “have,” “due,” “anticipate,” “assume,” “contemplate,” “continue” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operational performance or other events. The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. These forward-looking statements are based on management’s current expectations and involve a number of risks and uncertainties, including, but not limited to, the risks and uncertainties described under the heading “Risk Factors” in Part I, Item 1A of our most recent Annual Report on Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

APPROVAL OF AMENDMENTS TO OUR CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD OF DIRECTORS AND PROVIDE FOR ANNUAL ELECTIONS OF ALL DIRECTORS BEGINNING AT THE 2026 ANNUAL MEETING OF STOCKHOLDERS (PROPOSAL 1) General Our Certificate of Incorporation currently provides for a classified board structure, pursuant to which the Board is divided into three classes and directors are elected to staggered three-year terms, with members of one of the three classes elected every year. At our 2023 annual meeting of stockholders, our stockholders did not, by at least the required affirmative vote of at least 80% of the outstanding shares of our common stock, approve a proposal to amend our Certificate of Incorporation to eliminate the classified structure of the Board by the 2025 annual meeting of stockholders and allow for removal of directors with or without cause once the Board is no longer classified. After careful consideration, the Board unanimously approved, and recommends that our stockholders approve, amendments to our Certificate of Incorporation that, if adopted, would eliminate the classified structure of the Board by the 2026 annual meeting of stockholders and allow for removal of directors with or without cause once the Board is no longer classified. Summary of Principal Changes If this proposal is adopted, Article FIFTH of our Certificate of Incorporation will be amended to provide that all director nominees standing for election will be elected to a one-year term at or after the 2026 annual meeting of stockholders. To effect this change, we will enact a transitional two-class structure, combining our current Class II and Class III directors into a new Class I, with directors in current Class I being transitioned into a new Class II. Nominees elected to replace our current Class III directors, whose terms expire at the Annual Meeting, would be elected to a two-year term as new Class I directors, and nominees elected to replace our current Class I directors whose terms expire at the 2025 annual meeting of stockholders would be elected to a one-year term as new Class II directors. The transitional structure will then lapse, and as a result, beginning at the 2026 annual meeting of stockholders, and at each annual meeting thereafter, all directors will serve one-year terms. Directors elected to fill any vacancy on the Board or to fill newly created director positions resulting from an increase in the number of directors would serve the remainder of the term of that position. In connection with the declassification of our Board, Article FIFTH would also be amended to provide that, commencing with the election of directors at the 2026 annual meeting of stockholders, directors may be removed with or without cause as provided in the Delaware General Corporation Law (“DGCL”), and only the approval of a majority of the voting power of our stockholders would be required to remove a director with or without cause. This description of the proposed amendments to our Certificate of Incorporation is only a summary of those amendments and is qualified in its entirety by reference to, and should be read in conjunction with, the full text of Article FIFTH of our Certificate of Incorporation, marked to show the proposed amendments, a copy of which is attached to this proxy statement as Appendix B. If adopted, the amendments to our Certificate of Incorporation will become effective upon filing of the amended Certificate of Incorporation with the Secretary of State of Delaware, which is expected to occur promptly following the stockholder vote. If the amendments to our Certificate of Incorporation are approved by stockholders and become effective, the Board expects to approve certain conforming amendments to our Bylaws to remove references to a classified Board and to reflect stockholders’ ability to remove directors on an unclassified Board with or without cause at or after the 2026 annual meeting of stockholders. Recommendation and Vote Required The Board recommends that stockholders vote “FOR” the approval of amendments to our Certificate of Incorporation to declassify the Board and provide for annual elections of all directors beginning at the 2026 annual meeting of stockholders. The proxy holders will vote all proxies received “FOR” approval of this proposal unless instructed otherwise. Approval of the proposal requires the affirmative vote of at least 80% of the voting power of the outstanding shares of our common stock. Accordingly, abstentions and broker non-votes will have the effect of a vote “AGAINST” this proposal.

IF PROPOSAL 1 IS APPROVED, THE ELECTION OF HENRY E. BARTOLI, NAOMI L. BONESS AND PHILIP D. MOELLER AS CLASS I DIRECTORS OF THE COMPANY FOR A TERM OF TWO YEARS (PROPOSAL 1)2) OurIf Proposal 1 is approved and our board is re-classified, stockholders will vote to elect three directors to hold office for a two-year term expiring at the 2026 annual meeting of stockholders. In such event, the Board has recommended each of Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller for election as Class I directors under the transitional two-class structure described in Proposal 1 above, to serve until the 2026 annual meeting of stockholders or until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. All three individuals currently serve as Class III directors under our current class structure, whose terms expire at the Annual Meeting. Each of Mr. Bartoli, Dr. Boness and Mr. Moeller have agreed to serve if elected. The Board has nominated these directors following the recommendation of the Governance Committee.

Information regarding the director nominees is set forth below under the heading “Information Regarding Directors and Director Nominees.” Recommendation and Vote Required The Board recommends that stockholders vote “FOR” the election of each of Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller. You may vote “FOR” all director nominees or withhold your vote for any or all of the director nominees. Subject to our majority voting requirements described below, director nominees are elected by a plurality of the votes cast by the shares of our common stock entitled to vote in the election of directors at a meeting of stockholders at which a quorum is present. As a result, withheld votes and broker non-votes will have no effect on the election of directors. This means that the individuals nominated for election to the Board who receive the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. However, under our bylaws, any nominee for director is required to submit an irrevocable contingent resignation letter. If a nominee for director does not receive a majority of the votes cast “FOR” his or her election, the Board will act on an expedited basis to determine whether to accept the resignation. We refer to this process herein as the “majority voting requirements”. IF PROPOSAL 1 IS NOT APPROVED, THE ELECTION OF HENRY E. BARTOLI, NAOMI L. BONESS AND PHILIP D. MOELLER AS CLASS III DIRECTORS OF THE COMPANY FOR A TERM OF THREE YEARS (PROPOSAL 3) If Proposal 1 is not approved, stockholders will vote to elect three directors to hold office for a three-year term expiring at the 2027 annual meeting of stockholders. In such event, the Board has recommended each of Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller for election as Class III directors under our current class structure, to serve until the 2027 annual meeting of stockholders or until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. All three individuals currently serve as Class III directors whose terms expire at the Annual Meeting. Each of Mr. Bartoli, Dr. Boness and Mr. Moeller have agreed to serve if elected. The Board has nominated these directors following the recommendation of the Governance Committee. Information regarding the director nominees is set forth below under the heading “Information Regarding Directors and Director Nominees.” Recommendation and Vote Required The Board recommends that stockholders vote “FOR” the election of each of Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller as Class III Directors. You may vote “FOR” all three director nominees or withhold your vote for any or all of the director nominees. Subject to our majority voting requirements described above, director nominees are elected by a plurality of the votes cast by the shares of our common stock entitled to vote in the election of directors at a meeting of stockholders at which a quorum is present. As a result, withheld votes and broker non-votes will have no effect on the election of directors.

INFORMATION REGARDING DIRECTORS AND DIRECTOR NOMINEES The Board currently includes seven highly qualified directors with skills aligned to our business and strategy who bring significant value and diversity to the Company. Currently, ourThe Board is comprised of the following seven members: | | | | | | NAME | | | | CLASS | | | | YEAR TERM EXPIRES | | Stephen G. Hanks | Henry E. Bartoli | | | | Class III | | | | 2024 | | | | Naomi L. Boness | | | | Class III | | | | 2024 | | | | Philip D. Moeller | | | | Class III | | | | 2024 | | | | Joseph A. Tato | | | | Class I | | | | 2025 | | | | Kenneth M. Young | | | | Class I | | | | 2025 | | | | Alan B. Howe | | | | Class II | 2017 | | | 2026 | | Anne R. Pramaggiore | Rebecca L. Stahl | | | | Class II | 2017 | Thomas A. Christopher | Class III | 2018 | E. James Ferland | Class III2026 | 2018 | Larry L. Weyers | Class III | 2018 | Cynthia S. Dubin | Class I | 2019 | Brian K. Ferraioli | Class I | 2019 |

The Board currently consists of three classes of directors with each director serving a staggered three-year term. The Class I directors are Joseph A. Tato and Kenneth M. Young. The Class II directors are Alan B. Howe and Rebecca L. Stahl. The Class III directors are Henry E. Bartoli, Naomi L. Boness and Philip D. Moeller. If Proposal 1 is approved, the Board will convert to a transitional structure consisting of two classes of directors, with the directors in the new Class I serving until our 2026 annual meeting of stockholders and the directors in the new Class II serving until our 2025 annual meeting of stockholders. If Proposal 1 is approved, the directors currently in Class I and Class II will be designated as Class I directors, and the directors currently in Class III will be designated as Class II directors. | | DIRECTOR NOMINEES:

The stockholders are being asked to elect Stephen G. Hanks and Anne R. Pramaggiore to serve as Class II Directors for a term of three years. Both currently serve as Class II Directors whose terms expire at the Annual Meeting. They have agreed to serve if elected. Our Board has nominated these directors following the recommendation of the Governance Committee.

In response to the feedback from our stockholder outreach, our Board amended the Company's bylaws to provide for a majority voting standard for directors in uncontested elections.

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

|

Kenneth M. Young, a non-independent director, currently serves as Chairman of the Board. Because the Chairman is not an independent director, Alan B. Howe has been designated by the Board as Lead Independent Director in accordance with our Corporate Governance Principles.

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of the nominees listed in this proxy statement. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by the Board. However, we are not aware of any circumstances that would prevent any of the nominees from serving as a director.

The following section provides information with respect to each nominee for election as a director and each director of the Company who will continue to serve as a director after this year’sthe Annual Meeting. It includes the specific experience, qualifications and skills considered by the Governance Committee and/orand the Board in assessing the appropriateness of the person to serve as a director.director (ages are as of MayApril 1, 2017)2024).

Nominees | | | | Class II Nominees | | STEPHEN G. HANKS

HENRY E. BARTOLI

Director since 2015

Lead Independent Director

2020 Age: 66

Governance Committee (Chairman)

Compensation Committee77 | | | Qualifications: Mr. Hanks isHenry E. Bartoli, a seasoned executive with more than 35 years of experience in the former President and CEO of Washington Group International, Inc. (“Washington Group”), a global integrated engineering, construction and management services company, which merged with URS Corporation. He also served on its Board of Directors. Mr. Hanks has been retired since January 2008 and serves as a member of the board of directors of Lincoln Electric Holdings, Inc. (since 2006) and McDermott International, Inc. (“McDermott”) (since 2009).

Mr. Hanks brings to the Company’s board of directors valuable operations,power industry, and legal experience through his 30-year background with Washington Group and its predecessor, Morrison Knudsen Corporation. He also provides financial experience, having served as Chief FinancialStrategy Officer of Morrison Knudsen Corporation, and public company board experience through his service on the boards of Lincoln Electric Holdings, Inc. and McDermott. In addition, Mr. Hanks’ in-depth knowledge of corporate governance practices make him well qualifiedfor Babcock & Wilcox from 2018 to serve on our board of directors.

| | | ANNE R. PRAMAGGIORE

Director since 2015

Age: 58

Audit and Finance Committee

Compensation Committee

| Qualifications:

Since February 24, 2012, Ms. Pramaggiore has served as2020. Before that, he was President and Chief Executive Officer of Commonwealth Edison Company (“ComEd”), an electric utility company. PriorHitachi Power Systems America, LTD from 2004 to her current position, she served as ComEd’s President and Chief Operating Officer from May 2009 through February 23, 2012. Ms. Pramaggiore joined ComEd in 1998 and served as its2014. From 2002 to 2004, he was Executive Vice President Customer Operations, Regulatoryof The Shaw Group, after serving in a number of senior leadership roles at Foster Wheeler Ltd. from 1992 to 2002, including Group Executive and External Affairs from September 2007 to May 2009,Corporate Senior Vice President, RegulatoryEnergy Equipment Group, and External Affairs from November 2005 to September 2007,Group Executive and Corporate Vice President Regulatory and External AffairsGroup Executive, Foster Wheeler Power Systems Group. Before that, from October 20021971 to November 2005. She1992, he served in a number of positions of increasing importance at Burns and Roe Enterprises, Inc.

Mr. Bartoli also served as its Lead Counsel. Ms. Pramaggiore has also servedserves as a member of the Board of Directors of Motorola Solutions, Inc. since January 2013.FERMILAB, United States’ premier particle physics laboratory owned by the U.S. Department of Energy. Mr. Bartoli received a Bachelor of Science Degree in Mechanical Engineering from Rutgers University and a Master of Science Degree in Mechanical Engineering from New Jersey Institute of Technology. In addition, Ms Pramaggiore serves as a board member on the Chicago Federal Reserve Board. Ms. PramaggioreMr. Bartoli has held professional engineering licenses in California, Kentucky and New Jersey and is a licensed attorney and brings to the Company’s board of directors extensive experience in the utilities industry, as highlighted by her years of service at ComEd. Her experience as a current executive at another public company and her perspective on the technical, regulatory, operational and financial aspectsformer member of the power industry make her well qualified to serve on our boardBoard of directors.Trustees of Rutgers University. He also is a former member of the Board of Directors of the Nuclear Energy Institute.

| |

NAOMI L. BONESS

| | | Class III Directors | | THOMAS A. CHRISTOPHER

Director since 2015

2023

Age: 72

Governance Committee

Compensation Committee47 Board Committees Audit and Finance Related Party Transactions | | | Qualifications: Following his retirementDr. Naomi Boness (Ph.D.), has served as the Managing Director of the Natural Gas Initiative at Stanford University since 2019 and the Co-Managing Director of the Stanford Hydrogen Initiative since 2021. Dr. Boness is an experienced practitioner in 2009, Mr. Christopher has provided independent consultant servicesthe energy sector and is focused on using her background in reservoir geophysics and technoeconomic modeling to variousdevelop technology solutions related to natural gas, hydrogen and decarbonization. In addition to her research, she teaches classes in earth science and energy engineering and recently co-designed a graduate class on the hydrogen economy. She also is passionate about connecting technology developers with industry participants. Heto accelerate the deployment of new decarbonization technologies at scale.

Prior to Stanford, Dr. Boness held a variety of technical and management positions at Chevron from 2006 to 2019. She also currently serves ason the Board of Directors at Aemetis, a privately-held renewable fuels company, and geCKo Materials, a privately-held adhesive developer. She is Chairperson of the Advisory Board of Ambient Fuels, LLC, a privately-held green energy developer, and serves an advisor to a number of privately-held startups in the energy sector, including Ammobia, Veriten, EvolOH. Dr. Boness is a member of the OperatingRenewable Natural Gas Coalition Advisory BoardCommittee, a member of Fort Point Capital,the Partnership to Address Global Emissions Advisory Council, a private equity firm. He also teachesmember of the Open Hydrogen Initiative Independent Expert Panel, a graduate-level coursepast invited member of the United Nations Expert Group on Resource Classification, and a past Chair of the Society of Exploration Geophysicists Oil and Gas Reserves Committee. As an advocate for women and gender equality, she is proud to be an Ambassador for the Women in management principles atClean Energy, Education and Empowerment (C3E) Initiative. Dr. Boness holds a Doctorate in Geophysics from Stanford University, a Master’s Degree in Geological Sciences from Indiana University and a Bachelor’s Degree in Geophysics from the University of Pittsburgh. From January 2009 until his retirementLeeds. | |

| | PHILIP D. MOELLER Director since 2020 Age: 62 Board Committees Compensation Governance Related Party Transactions | | | Qualifications: The Honorable Philip D. Moeller is Executive Vice President, Business Operations Group and Regulatory Affairs at the Edison Electric Institute (EEI). EEI is the association that represents all of the nation’s investor-owned electric companies. Mr. Moeller has significant responsibility over a broad range of issues that affect the future structure of the electric power industry and new rules in June 2009, Mr. Christopher served asevolving competitive markets. He has responsibility over the Vice Chairmanstrategic areas of Areva NP Inc. (“Areva”), a commercial nuclear power engineering, fuelenergy supply and nuclearfinance, energy delivery, energy services, company. Previously, he served as Areva’s Presidentfederal and Chief Executive Officer from April 2000 to January 2009state regulatory issues, and served on Areva’s global Executive Committee in France from January 2005 until December 2008. international affairs. Prior to joining ArevaEEI in 2000,February 2016, Mr. ChristopherMoeller served as Vicea Commissioner on the Federal Energy Regulatory Commission (FERC), ending his tenure as the second-longest serving member of the Commission. In office from 2006 through 2015, Mr. Moeller ended his service as the only Senate-confirmed member of the federal government appointed by both President George W. Bush and General ManagerPresident Barack Obama. At FERC, Mr. Moeller championed policies promoting improved wholesale electricity markets, increasing investment in electric transmission and natural gas pipeline infrastructure, and enhancing the coordination of Siemens/Westinghouse Power Services Divisions since August 1998, Vice Presidentthe electric power and General Managernatural gas industries. Earlier in his career, Mr. Moeller headed the Washington, D.C. office of WestinghouseAlliant Energy Services Divisions from January 1996 until August 1998,Corporation. He also served as a Senior Legislative Assistant for Energy Policy to U.S. Senator Slade Gorton (R-WA), and Vice Presidentas the Staff Coordinator of the Washington State Senate Energy and General Manager of Westinghouse Global Nuclear Service Divisions from July 1982 until December 1996. Mr. Christopher also spent six years with the U.S. Navy as an officerTelecommunications Committee in the nuclear submarine force, holding the naval reactors engineer certification.Olympia, Washington. Mr. Christopher brings an extensiveMoeller was born in Chicago and unique understanding of fossil power operations, the power market and power engineering to the Company’s board of directors. As an energy business executive, he is familiar with our key customers and their investment decision making process.raised on a ranch near Spokane, Washington. He is also experiencedreceived a BA in managing international operations for energy services companies throughout the world. Mr. Christopher’s management experience and technical background in the energy industry make him well qualified to serve on our board of directors.Political Science from Stanford University. | |

Continuing Directors | | | E. JAMES FERLAND

ALAN B. HOWE

Director since 2015

2019 Age: 5062 Board Committees Audit and Finance Compensation Governance Related Party Transactions | | | Qualifications: E. James Ferland serves as our ChairmanAlan B. Howe has over 30 years of extensive hands-on operational expertise combined with corporate finance, business development and Chief Executive Officer. Priorcorporate governance experience. Mr. Howe has a broad business background and has been exposed to the spin-off,a wide variety of complex business situations within large corporations, financial institutions, start-ups, small-caps and turnarounds.

Currently, Mr. Ferland was BWC’s President and Chief Executive Officer since April 2012. Prior to joining BWC, Mr. Ferland served as PresidentHowe is Managing Partner of the Americas division for Westinghouse Electric Company,Broadband Initiatives, LLC, a nuclear energy companysmall boutique corporate advisory firm that he manages. His specialty is in providing board and group companyC-level leadership working with small-cap and micro-cap companies (both public and private) particularly in turnaround situations. Mr. Howe has served both as a director and as a board chairman in over 29 public companies (and 4 private companies) in a variety of Toshiba Corporation, from 2010 through March 2012. From 2007 to 2010,industries including telecom and wireless equipment, software, IT services, wireless RF services, manufacturing, semi-conductors, environmental technology and storage. In two situations, Mr. Ferland worked for PNM Resources, Inc., a holding companyHowe was appointed interim CEO of utilities providing electricity and energy products and services,turn-arounds where he held positions as Senior Vice President of Utility Operations and Senior Vice President of Energy Resources. Previously, Mr. Ferland held various senior management and engineering positions at Westinghouse Electric Company, Louisiana Energy Services/URENCO, Duke Engineering and Services, Carolina Power & Light and General Dynamics. Mr. Ferland has alsopreviously served on the boardBoard of directors of Actuant Corporation since August 2014.Directors. Mr. Ferland is an experienced executive with a utility leadership background that includes both regulated and merchant operations. He has led organizations that generate power (coal, nuclear, gas, renewables), transmit power and trade power. He also has extensive supplier leadership experience in commercial nuclear power, manufacturing, engineering and field services. With more than 25 years of senior management and engineering experience in diversified industries, he brings valuable perspectives to all industries in which we operate.

| |

| | | | | | LARRYREBECCA L. WEYERS

STAHL

Director since 2015

2020 Age: 71

Compensation

Committee (Chairman)

50 Board Committees Audit and Finance Committee Compensation Related Party Transactions | | | Qualifications: In March 2010, Mr. Weyers retired as Chairman of Integrys Energy Group, Inc. (previously WPS Resources Corporation), a holding company with operations providing products and services in regulated and non-regulated energy markets. Previously, he served as its Chairman, President and Chief Executive Officer from February 1998 to December 2008, having joined Wisconsin Public Service Corporation, a utility subsidiary of Integrys Energy Group, Inc., in 1985. From 1998 through 2007, Mr. Weyers used internal growth and acquisitions to increase revenues from $878 million to $10.3 billion, increase income from $53.7 million to $251.3 million, and increase market cap from $808 million to $3.9 billion. The average annual return to stockholders exceeded 10%.

Mr. WeyersRebecca Stahl has served on boards in banking, hospital administration, electric transmission, the paper industry and insurance. Throughout his career he has served on numerous not-for-profit boards. From 2010 to 2015, he served as Vice President and Lead Director of the board of directors of Green Bay Packers, Inc., on which he served beginning in 2003.

Mr. Weyers brings a wealth ofover 25 years’ experience in the power generation industry to the Company’s board of directorsfinance and possesses substantial corporate leadershipaccounting, and governance skills. Having served over 24 years with Integrys Energy Group, Inc., he has extensive knowledge of the utility industry and provides a valuable resource for our power generation operations.

| Class I Directors | CYNTHIA S. DUBIN

Director since 2015

Age: 55

Audit and Finance Committee

Governance Committee

| Qualifications:

From November 2011 through January 2016, Ms. Dubin served as Finance Director of JKX Oil & Gas plc, a publicly held oil and gas exploration, development and production company. Prior to joining JKX Oil & Gas plc, she co-founded and servedcurrently serves as Chief Financial Officer of Canamens Energy Limited,The Association For Manufacturing Technology (AMT), an oilorganization that represents and gas explorationpromotes U.S.-based manufacturing technology and productionits members who design, build, sell, and service the industry. Before joining AMT, she held positions of increasing responsibility at Lightbridge Communications Corporation (LCC), a multinational wireless engineering company, focused onincluding serving as Chief Financial Officer from 2008 to 2015. While at LCC, she led several financing rounds, senior bank refinancing and M&A transactions that led to an eventual sale of the Caspian, North Africa, Middle East and North Sea regions, from 2006 to 2011. company in 2015.

Prior to joining Canamens Energy Limited,LCC, Ms. DubinStahl was with BT Infonet, a multinational data communications company, as a senior finance professional supporting a $600 million operation. From 1998-2000, she served as Vice President and Finance Director, Europe, Middle East and Africa Divisionin corporate finance for Edison Mission Energy, a U.S. owned electric power generator which developed, acquired, financed, owned and operated reliable and efficient power systems. Ms. DubinThe Walt Disney Company in Burbank, Calif. She started her career at The BankArthur Anderson LLP serving clients of New Yorkpublic and Mitsubishi Bank advising onprivate companies in the real estate and lending to large energy projects.financial services industries. Ms. Dubin brings valuableStahl is a certified public accountant. She earned a Bachelor of Science in Accounting from The Pennsylvania State University, and a Master of Business Administration from the Anderson School of Management at University of California Los Angeles, with an emphasis in Finance. Her professional affiliations include Women Corporate Directors, the American Institute of Certified Public Accountants and Virginia Society of Certified Public Accountants. | |

| | JOSEPH A. TATO Director since 2020 Age: 70 Board Committees Audit and Finance Governance Related Party Transactions | | | Qualifications: Joseph A. Tato has significant leadership experience in the areas of energy and natural resources, infrastructure project development and finance, and has been counsel in some of the largest public-private partnership transactions completed to date including for energy industry experienceand water projects in the U.S. and globally. Mr. Tato joined Steptoe LLP, in 2024 as Senior Counsel, responsible for project development and finance as well as energy transactional matters. Prior to the Company’s boardjoining Steptoe, from 2020 to 2024, Mr. Tato was Partner at Covington & Burling, LLP and then Senior Counsel in 2024, responsible for Project Development & Finance, as well as a unique understandingmember of its Africa and Latin America Practice Groups. From 2012 to 2020, he was a Partner with DLA Piper, LLP, and Chair of Projects and Infrastructure, as well as Co-Chair of its Energy Sector and a member of its Africa Committee. Before that, from 1983 to 2012, Mr. Tato was an associate and since 1988 a Partner with LeBoeuf, Lamb, Greene & MacRae, LLP (Dewey & LeBoeuf LLP), and served as Chair of Global Project Finance and its Africa Practice. He has served as Director, Cameroon Enterprises, since 2017. Additionally, he has served as Director, Covanta Energy Corporation, from 2000 to 2004, and as Assistant Secretary and Counsel to the Board of Directors of SITA U.S.A., a subsidiary of Suez, from 1996 to 1999. | |

| | KENNETH M. YOUNG Director since 2020 Age: 60 Chairman of the globalBoard | | | Qualifications: Kenneth Young is Chairman and EuropeanChief Executive Officer of Babcock & Wilcox, a leader in energy markets. Withand environmental products and services for power and industrial markets worldwide. Mr. Young, who has served as Chief Executive Officer since November 2018 and Chairman since September 2020, has more than 30 years of global operational, executive and director experience inprimarily within the energy, sector combined with her financial expertisecommunications and her international leadership experience, Ms. Dubin is a valuable memberfinance industries. Mr. Young also serves as President of our board of directors. |

| | | BRIAN K. FERRAIOLI

Director since 2015

Age: 61

Audit and Finance

Committee (Chairman)

Governance Committee

| Qualifications:

From October 2013 throughFebruary 2017, Mr. Ferraioli served as Executive Vice PresidentB. Riley Financial, Inc., and Chief FinancialExecutive Officer for B. Riley Principal Investments, a wholly owned subsidiary of KBR, Inc.B. Riley Financial.

Before joining B. Riley, he held executive leadership positions with Lightbridge Communications Corporation (LCC), a global engineering,which was the largest independent telecom construction and services company supportingin the energy, hydrocarbons, power, mineral, civil infrastructure, government services, industrialworld and commercial markets.a recognized leader in providing network services. Prior to joining KBR, Inc., he servedLCC, Mr. Young was Chief Marketing and Operations Officer with Liberty Media’s TruePosition and held various senior executive positions with multiple corporations, including Cingular Wireless, SBC Wireless, Southwestern Bell Telephone and AT&T as Executive Vice President and Chief Financial Officerpart of The Shaw Group, Inc., a former NYSE listed global provider of technology, engineering, procurement, construction, maintenance, fabrication, manufacturing, consulting, remediation, and facilities management services to a diverse client base that includes regulated electric utilities, independent and merchant power producers, government agencies, multinational and national oil companies, and industrial corporations. Mr. Ferraioli was with Shaw from July 2007 until February 2013 whenhis 16-year tenure within the company was acquired by Chicago Bridge & Iron Company N.V. His earlier positions include Vice President and Controller for Foster Wheeler, AG, a global engineering and construction company, and Vice President and Chief Financial Officer of Foster Wheeler USA and of Foster Wheeler Power Systems, Inc.now-combined AT&T Corporation. Mr. FerraioliYoung holds a Bachelor of Science in Computer Science from Graceland University and a Master of Business Administration from the University of Southern Illinois. Mr. Young has over 38 years of experience in senior-level finance and accounting roles in the engineering and construction industry. In addition, his extensive background with publicly traded companies makes him a valuable member of our board of directors.previously served on nine public company boards. | |

B. Riley Investor Rights Agreement

On April 30, 2019, we entered into an investor rights agreement (the “Investor Rights Agreement”) with B. Riley Financial, Inc. (together with its affiliates, “B. Riley”). Pursuant to the Investor Rights Agreement, B. Riley retains its right to nominate one director to serve on our Board so long as B. Riley continues to meet certain quantitative ownership thresholds with regard to our common stock. As of the date hereof, B. Riley has the right to nominate one member of our Board. The Investor Rights Agreement also provides pre-emptive rights to B. Riley with respect to certain future issuances of our equity securities.

Summary of Director Core Competencies and Attributes OurThe Board of Directors provides effective and strategic oversight to support the best interests of our Companyus and itsour stockholders. The following chart summarizes the core competencies and attributes represented on our Board.by each of the director nominees. More details on each director’s competencies are included in the director profiles on the previous pages.

| | Competencies / Attributes | | | Kenneth M.

Young | | | Henry E.

Bartoli | | | Naomi L.

Boness | | | Alan B.

Howe | | | Philip D.

Moeller | | | Rebecca L.

Stahl | | | Joseph A.

Tato | | | | COMPLIANCE CONSIDERATIONS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Independent Director | | | | | | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Financial Expertise | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | CORE COMPETENCIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Recent or current public company CEO/COO/CFO/GC | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | | | | | | | | | | | | | | | | | | Power Generation | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | | | | | | | ● | | | | | Manufacturing | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ● | | | | | Engineering and Construction | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | Utility / Power Transmission Distribution | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | | | | | | | ● | | | | | International Operations | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | Emerging Energy Technologies | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | STRATEGIC COMPETENCIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Financial (Reporting, Auditing, Internal Controls) | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | Strategy / Business Development / M&A | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Human Resources / Organizational Development | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Legal / Governance / Business Conduct | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Risk Management | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Public Policy / Regulatory Affairs | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | | | | | | | ● | | | | | Environmental, Social & Corporate Governance (ESG) | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | Cybersecurity | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | | | | PUBLIC COMPANY BOARD EXPERIENCE | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Board of similar or larger size company | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | | | | | | | | | | | | | | ● | | | | | Audit / Finance committee experience with other companies | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | | | | | | Compensation committee experience with other companies | | | | | | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | Nomination / Governance committee experience with other companies | | | | | ● | | | | | | | | | | | | ● | | | | | | ● | | | | | | ● | | | | | | | | | | | | ● | | |

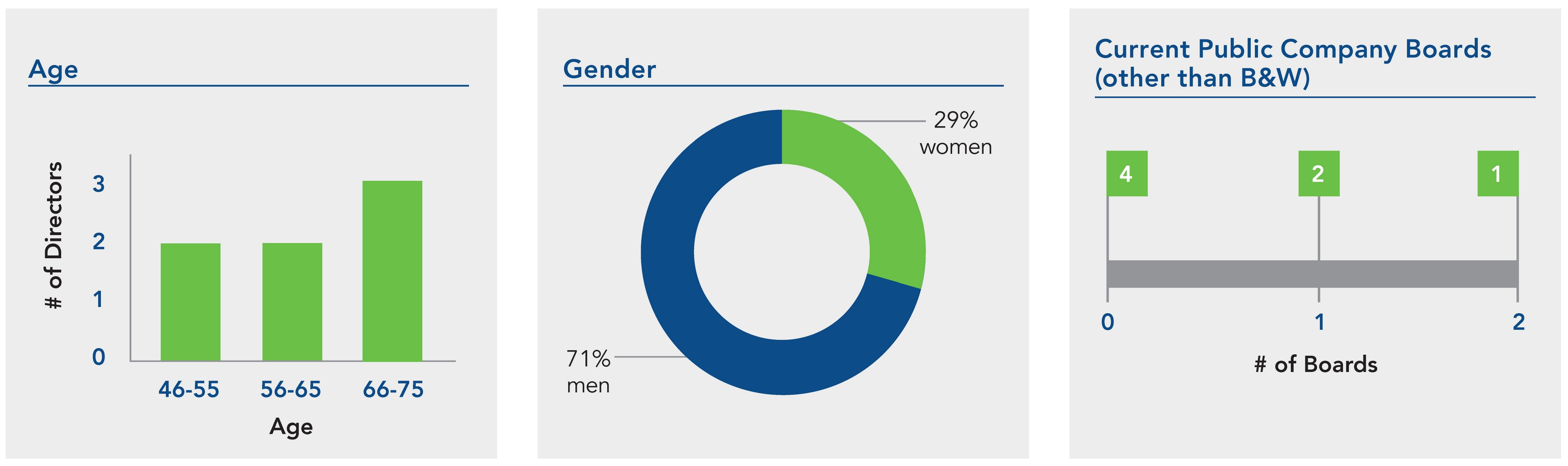

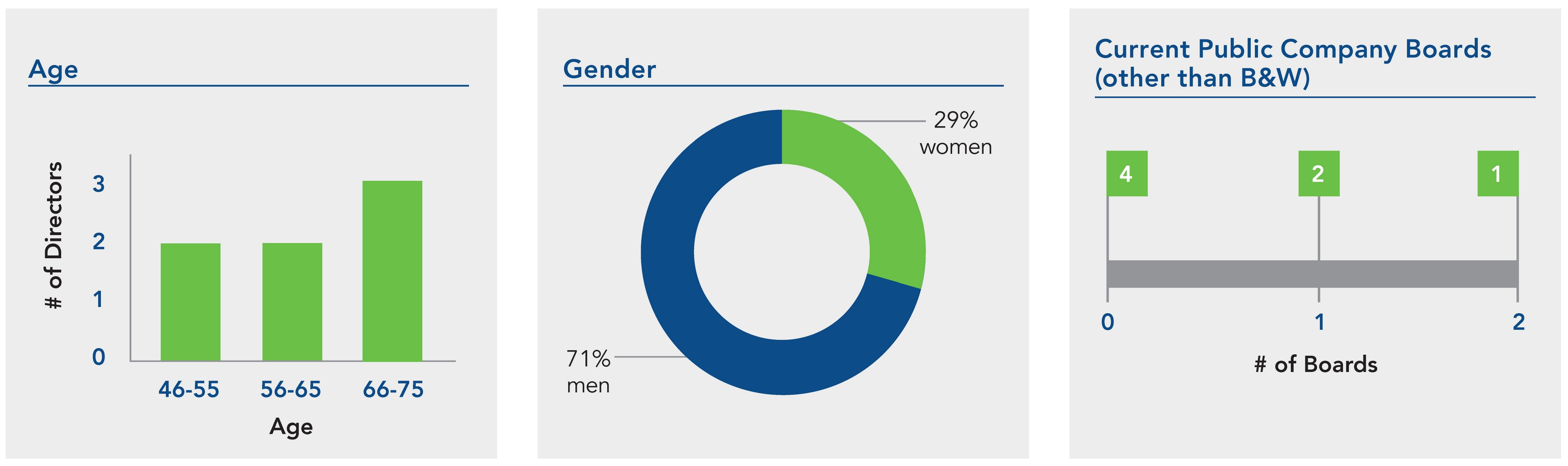

| | | | | | | | | | Competencies / Attributes | Thomas A. Christopher | Cynthia S. Dubin | E. James Ferland | Brian K. Ferraioli | Stephen G. Hanks | Anne R. Pramaggiore | Larry L. Weyers | | COMPLIANCE CONSIDERATIONS | | | | | | | | | Independent Director | ● | ● | | ● | ● | ● | ● | | Financial expertise | | ● | ● | ● | ● | ● | ● | | CORE COMPETENCIES | | | | | | | | | Recent or current public company CEO/COO/CFO/GC | | ● | ● | ● | ● | ● | ● | | Fossil Fuel Power Generation | ● | ● | ● | ● | ● | ● | ● | | Manufacturing | ● | | ● | ● | | | | | Engineering and Construction | ● | | ● | ● | ● | | | | Utility / Power Transmission Distribution | | ● | ● | | | ● | ● | | International Operations | ● | ● | ● | ● | ● | ● | ● | | STRATEGIC COMPETENCIES | | | | | | | | | Financial (Reporting, Auditing, Internal Controls) | ● | ● | ● | ● | ● | ● | ● | | Strategy / Business Development / M&A | ● | ● | ● | ● | ● | ● | ● | | Human Resources / Organizational Development | ● | ● | ● | ● | ● | ● | ● | | Legal / Governance / Business Conduct | ● | ● | ● | ● | ● | ● | ● | | Risk Management | ● | ● | ● | ● | ● | | ● | | Public Policy / Regulatory Affairs | ● | | ● | | | ● | ● | | PUBLIC COMPANY BOARD EXPERIENCE | | | | | | | | | Board of similar or larger size energy company | | ● | | | ● | ● | ● | | Audit / Finance (Board committee experience with other companies) | | ● | ● | | ● | | ● | | Compensation (Board committee experience with other companies) | | ● | | | ● | ● | ● | | Nomination / Governance (Board committee experience with other companies) | | | ● | | | ● | ● | | PERSONAL | | | | | | | | | Current Public Boards (other than B&W) | 0 | 0 | 1 | 0 | 2 | 1 | 0 | | Age (as of May 1, 2017) | 72 | 55 | 50 | 61 | 66 | 58 | 71 | | Gender | M | F | M | M | M | F | M |

8

CORPORATE GOVERNANCE Our Corporate Governancecorporate governance policies and structures provide the general framework for how we run our business. They demonstrate our commitment to ethical values, to strong and effective operations and to assuring continued growth and financial stability for our stockholders. The corporate governance section on our Web sitewebsite contains copies of our principal governance documents. It is found at www.babcock.com at “Investors“Company — Corporate — Investors — Corporate Governance” and contains the following documents: Amended and Restated Bylaws Corporate Governance Principles Code of Business Conduct Code of Ethics for Chief Executive Officer and Senior Financial Officers Audit and Finance Committee Charter Compensation Committee Charter Governance Committee Charter Related Party Transactions Committee Charter Conflict Minerals Policy Related Party Transactions Policy Modern Slavery Transparency Statement Director Independence The New York Stock Exchange (“NYSE”) listing standards require ourthe Board to consist of at least a majority of independent directors.directors, and our Corporate Governance Principles require the Board to consist of at least a majority of independent directors and at least 66% independent directors who satisfy all NYSE listing standards for independence other than Section 303A.02(b)(iv) of the NYSE listed company manual. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with us. The Board has established categorical standards, which conform to the independence requirements in the NYSE listing standards, to assist it in determining director independence. These standards are contained in the Corporate Governance Principles found on our Web sitewebsite at www.babcock.com under “Investors“Company — Corporate — Investors — Corporate Governance — Governance Documents.” Based on these independence standards, ourthe Board has determined that the following directorseach of Naomi L. Boness, Alan B. Howe, Philip D. Moeller, Rebecca L. Stahl and Joseph A. Tato are independent and meet our categorical standards: | | | Thomas A. Christopher | Stephen G. Hanks | Cynthia S. Dubin | Anne R. Pramaggiore | Brian K. Ferraioli | Larry L. Weyers |

standards. Kenneth M. Young and Henry E. Bartoli have been determined to not be independent due to their employment and consulting relationships with the Company, respectively.In determining the independence of the directors, ourthe Board considered ordinary course transactions between us and other entities with which theeach of our directors are associated.associated, including B. Riley, a significant stockholder of the Company. Those transactions are described below, although none wereas well as the related party transactions described under “Certain Relationships and Related Transactions” in this proxy statement. None of these transactions was determined to constitute a material relationship with us. Althoughus with respect to any director determined to be independent. B. Riley has also entered into a consulting agreement with us in connection with Mr. Weyers has no current relationship with the Company exceptYoung’s service as a director and stockholder, he is the former chairman of the board of directors of Integrys Energy Group, Inc., with which we have transacted business in the ordinary course during the last three years. Mr. Ferraioli was formerly an officer of an entity with which we have transacted business in the ordinary course during the last three years, and Ms. Pramaggiore is currently an officer of an entity with which we have transacted business in the ordinary course during the last three years. Mr. Hanks is a director of an entity with which we transact business in the ordinary course.our Chief Executive Officer.

Board Function, Leadership Structure and Executive Sessions OurThe Board oversees, counsels and directs management in the long-term interest of the Companyus and our stockholders. The Board’s responsibilities include:

•

overseeing the conduct of our business and assessing our business and enterprise risks, including cybersecurity and ESG risks; •

reviewing and approving our key financial objectives, strategic and operating plans, and other significant actions; •

overseeing the processes for maintaining the integrity of our financial statements and other public disclosures, and our compliance with law and ethics;

•

evaluating CEO and senior management performance and determiningdetermines executive compensation; •

planning for CEO succession and monitoring management’s succession planning for other key executive officers; and •

establishing our effective governance structure, including appropriate board composition and planning for board succession. Our

The Board does not have a policy requiring either that the positions of the Chairman and the Chief Executive Officer should be separate or that they should be occupied by the same individual. OurThe Board believes that this issue is properly addressed as part of the succession planning process and that it is in theour best interests of the Company for the Board to make a determination on these matters when it elects a new Chief Executive Officer or Chairman of the Board or at other times consideration is warranted by circumstances. Currently, the roles are combined, withWe currently have Mr. FerlandYoung serving as our Chairman and Chief Executive Officer.Officer and as our Chairman. Pursuant to our Corporate Governance Principles, in the event the Chairman of the Board is not an independent director, the independent directors will annually appoint a Lead Independent Director with such responsibilities as the Board shall determine from time to time. The independent directors haveIf appointed, Stephen G. Hanks as Lead Independent Director. Thethe Lead Independent Director has the following responsibilities: •

presides over all Board meetings at which the Chairman of the Board is not present and all executive sessions attended only by independent directors; •

serves as liaison between the independent directors and the Chairman of the Board and Chief Executive Officer (including advising the Chairman of the Board and Chief Executive Officer of discussions held during executive sessions of the non-employee and independent directors, as appropriate); •

reviews and approves the Board meeting agendas and meeting schedules to assure that there is sufficient time for discussion of all agenda items; •

advises the Chairman of the Board and Chief Executive Officer regarding the quality, quantity and timeliness of information sent by management to the directors; •

has the authority to call meetings of the independent directors; and if requested by major stockholders,

•

ensures that he or she is available for consultation and direct communication.communication, as appropriate. Because the Chairman is not an independent director, the Board has designated Mr. Howe as Lead Independent Director. The Board believes that this leadership structure is appropriate for us at this time because it provides our Chairman with the readily availablereadily-available resources to manage the affairs of the Board while allowing our Lead Independent Director to provide effectiveBoard. Our Chairman and timely advice and guidance. Our Lead Independent Director works closely and collaboratively with our Chairman toChief Executive Officer ensure that the views of the Board are taken into account as management carries out the business of the Company.Company and vice-versa. Our independent directors, led by our Lead Independent Director, retain the opportunity to meet in executive session without management at the conclusion of each regularly scheduled Board and committee meeting.

Director Nomination Process Our Governance Committee is responsible for assessing the qualifications, skills and characteristics of candidates for election to the Board. The Board, after taking into account the assessment provided by our Governance Committee, is responsible for considering and recommending to stockholders the nominees for election as directors at each annual meeting. In making this assessment,their assessments, the Governance Committee and the Board generally considersconsider a number of factors, including each candidate’s: •